Transforming the Event Budget from Cost to Capital

For too long, the budget in corporate event management has been viewed as a necessary evil—a fixed cost to be minimized. However, in today’s data-driven corporate landscape, the event budget is one of the most powerful strategic tools available. It represents concentrated capital expenditure with the potential for exceptional Return on Investment (ROI).

The transition from viewing budget as a cost center to a profit driver is the hallmark of advanced corporate event management. It requires a shift from allocating funds based on traditional percentages (e.g., “15% for F&B”) to an ROI-focused methodology where every dollar is strategically deployed to achieve specific, measurable business objectives.

This comprehensive guide is designed for marketing and finance professionals who want to master the art of budget allocation. We will unveil the advanced frameworks that link your event spend directly to your company’s strategic goals, ensuring every corporate event delivers maximum, quantifiable value.

See More: The Ultimate List of Event Management Companies in Singapore (2025 Guide)

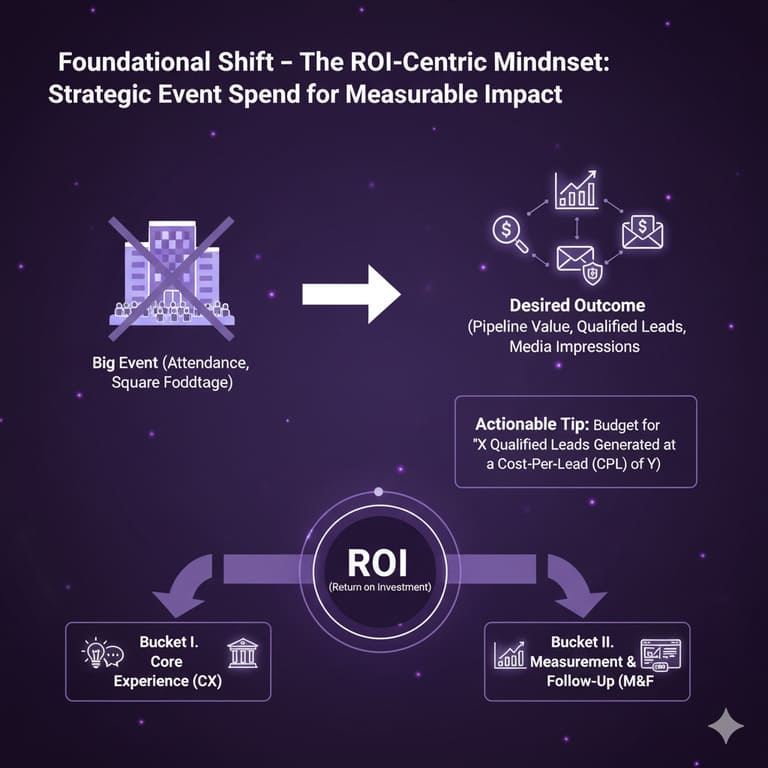

Foundational Shift – The ROI-Centric Mindset

Before touching the numbers, advanced corporate event management demands a strategic realignment:

Defining Success: Beyond Attendance Metrics

The most common budget mistake is allocating funds based on the perceived size of the event (number of attendees, square footage). An ROI-focused approach allocates funds based on the desired outcome (e.g., pipeline value, number of qualified leads, media impressions, speed of deal closing).

- Actionable Tip: Instead of budgeting for a “Big Event,” budget for “X Qualified Leads Generated at a Cost-Per-Lead (CPL) of Y.”

The Three Buckets of Strategic Event Spend

Every dollar should be categorized into one of these three strategic buckets, defining its primary purpose:

| Bucket | Definition | Budget Priority |

| I. Core Experience (CX) | Spend directly impacting attendee engagement, memory, and conversion (e.g., keynote quality, personalized tech, content production). | Highest. This drives the desired behavior and messaging. |

| II. Logistics & Compliance (L&C) | Spend ensuring the event happens smoothly and legally (e.g., venue, security, insurance, basic F&B). | Essential but controlled. Use procurement strategy to minimize waste. |

| III. Measurement & Follow-Up (M&F) | Spend dedicated to capturing data, calculating ROI, and nurturing leads post-event (e.g., CRM integration, dedicated lead scanners, follow-up content production). | Strategic. This ensures the event has digital longevity and measurable success. |

See More: 7 Ways an Event Management System Boosts Attendee Engagement (A 2025 Guide)

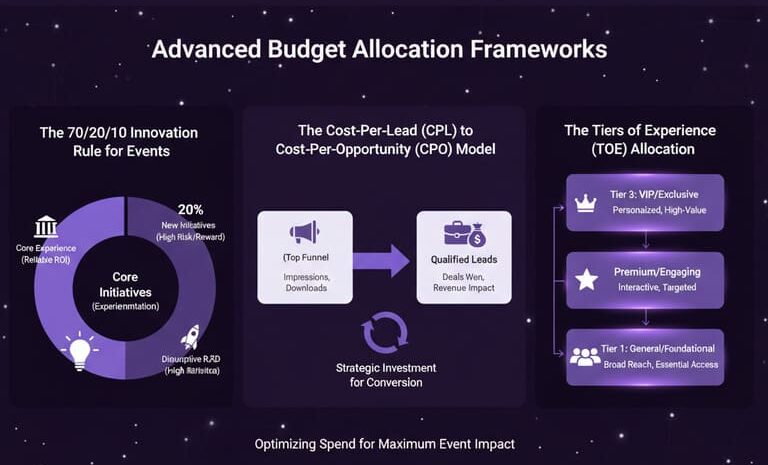

Advanced Budget Allocation Frameworks

The core of ROI-focused corporate event management lies in these detailed allocation models.

The 70/20/10 Innovation Rule for Events

This model encourages controlled experimentation, ensuring your budget constantly seeks maximum ROI by dedicating funds to innovation:

- 70% Core Allocation (Proven ROI): Funds dedicated to reliable elements with a historically proven return (e.g., a well-vetted AV company, standard venue fees, basic catering). This ensures the event is executed flawlessly.

- 20% Strategic Investment (High Potential): Funds dedicated to key drivers of the desired outcome (e.g., hiring a Tier 1 keynote speaker, investing in an advanced networking app, a high-touch VIP zone). This is where the budget is adjusted to hit the specific KPI.

- 10% Innovation Fund (Future Growth): Funds reserved for new technologies or unique experiential elements (e.g., AR/VR activation, AI-powered personalization, a new sustainable catering concept). This ensures your events stay cutting-edge and competitive.

The Cost-Per-Lead (CPL) to Cost-Per-Opportunity (CPO) Model

For B2B corporate event management, the budget should be justified by the sales pipeline it generates. This model forces a shift from just counting attendees to quantifying sales potential.

- The Formula: Allocate event costs based on the average expected CPO. If your average sales pipeline value requires a CPO of $500, then your total event cost must be less than $500 multiplied by the number of qualified opportunities expected.

- Strategic Adjustment: By identifying high-value audience segments (e.g., C-Suite executives), you justify spending more on their personalized CX (Bucket I), accepting a higher CPL for that small segment because their conversion rate and deal size (CPO) are significantly higher.

The Tiers of Experience (TOE) Allocation

This framework is critical for events with mixed audiences (e.g., C-level, media, general attendees). It prevents budget dilution by allocating higher-quality resources to the audience segments with the highest potential ROI.

| Audience Tier | ROI Value | Budget Focus (Example) | Allocation % Shift |

| Tier 1 (VIP/C-Suite) | Highest (Direct Deal Flow) | High-touch logistics, private dining, executive briefing rooms. | Allocate disproportionately higher per capita cost. |

| Tier 2 (Qualified Leads/Media) | Medium (Pipeline/Buzz) | Enhanced networking tech, exclusive panel access, premium F&B. | Allocate high cost to engagement tools (Tech in Bucket I). |

| Tier 3 (General Attendees) | Baseline (Awareness/Nurture) | Efficient logistics, strong content access, effective registration. | Optimize L&C (Bucket II) for cost efficiency. |

See More: The 3-Step Media Strategy Your Singapore Corporate Event Organizer Must Master

Advanced Budget Management and Control

Even with the best allocation plan, cost overruns can derail ROI. Top-tier corporate event management requires expert budget control.

Zero-Based Budgeting (ZBB) for Events

Instead of modifying last year’s budget, ZBB requires planners to justify every expense from zero, aligning each item with a specific event KPI.

- Process: Start with the desired event outcome (KPIs). Work backward, defining only the activities necessary to achieve those KPIs. For instance, if the KPI is “increase product trials,” the budget allocation shifts from a decorative stage set to interactive trial stations and dedicated tech support. This ruthlessly cuts legacy spending that no longer delivers value.

Contingency: The Strategic Reserve

The contingency fund (typically 10–15% of the total budget) should be managed as a strategic reserve, not just a buffer for errors.

- Strategic Use: Allocate a portion of the contingency for opportunistic spending. If a competitor cancels their marketing push, or a highly desired keynote speaker suddenly becomes available two weeks out, the strategic reserve allows the corporate event management team to pivot and seize the opportunity for a high-ROI spend. This transforms the contingency from a defensive tool to an offensive one.

Procurement Synergy: Leveraging Volume Discounts

The advanced planner uses a centralized procurement strategy to maximize discounts across multiple events.

- Strategy: Negotiate multi-event contracts for core services (AV, hotel blocks, furniture rental). Even if events are disparate in type, bundling services allows the corporate event management team to achieve Tier 1 pricing from vendors, re-allocating the savings back into Core Experience (Bucket I).

See More: How to Plan an Unforgettable Awards Ceremony That Inspires Your Team

Frequently Asked Questions (FAQs) on Corporate Event Management

Here are 8 deep-level questions often discussed by clients and top-tier corporate event management professionals:

1. How can we ensure our corporate events drive measurable long-term sales pipeline value?

The key is in CRM integration (Customer Relationship Management). Every attendee touchpoint (registration, session attended, booth visit, post-event survey response) must be captured and logged against their contact record. This allows the sales team to precisely quantify the pipeline value influenced by the event six to twelve months later, proving the long-term ROI.

2. What is the fundamental difference between an ‘Event Planner’ and a strategic ‘Corporate Event Manager’?

An Event Planner focuses primarily on execution, logistics, and vendor management. A strategic Corporate Event Manager focuses on business objectives, ROI alignment, risk mitigation, and integrating the event into the overarching marketing and sales funnel. The latter acts as a strategic consultant.

3. In hybrid event management, how should the budget be split between physical and virtual components?

The traditional 80/20 split (physical/virtual) is outdated. A modern hybrid event requires a split closer to 60/40 or 55/45. The virtual 40% is non-negotiable, covering costs for dedicated dual production crews, robust streaming platforms, interactive digital tools, and unique virtual content designed specifically for the online audience.

4. What are the most overlooked compliance and insurance costs in international corporate event management?

Overlooked costs often include Cross-Border Tax Liability (especially for ticket sales or sponsorships), Force Majeure clauses that do not cover pandemics or civil unrest specifically, and Intellectual Property licensing fees for all music, visual content, and public broadcasts in foreign jurisdictions.

5. How do leading companies define and quantify the “Soft ROI” (e.g., employee morale, brand perception) from corporate events?

Soft ROI is quantified through structured post-event surveys utilizing standardized metrics (e.g., Net Promoter Score – NPS for the event, specific Likert scales for morale/engagement), and through social listening/media monitoring tools that track brand sentiment shifts immediately following the event. These metrics are then correlated with long-term HR/marketing goals.

6. What is the role of the Zero-Based Budgeting methodology in negotiating with high-end venues?

ZBB empowers the event manager to negotiate effectively by forcing them to know the minimum viable cost for every component. If the venue’s in-house AV quote is excessive, ZBB justifies bringing in an outside vendor because the in-house cost does not align with the defined, justified ROI of the AV component.

7. How can technology investment in corporate events be justified beyond the event lifecycle?

Justification comes from the asset lifecycle. For instance, an investment in a custom event app can be reused and repurposed across multiple internal and external events for years, amortizing the initial cost. Similarly, high-quality event video content is a marketing asset used for lead nurturing for 12+ months post-event.

8. What are the key indicators that a corporate event budget is being strategically mismanaged?

Key indicators include: budget allocated heavily to unmeasured vanity elements (e.g., overly elaborate decor), minimal spend on the Measurement & Follow-Up Bucket (M&F), frequent last-minute changes due to lack of a strategic framework, and a final budget report that only compares actual spend to planned spend, failing to report against the initial business KPIs.

See More: How Much Does It Cost to Hire an Event Management Company in Singapore?

Conclusion: Your Budget, Your Strategy

The modern landscape of corporate event management demands financial discipline rooted in strategic planning. By adopting the advanced frameworks outlined in this guide—from the 70/20/10 Rule to the CPL-to-CPO Model—you shift the perception of your event budget from a corporate expense to a highly optimized capital investment. This is not just about saving money; it’s about spending money precisely where it generates the highest strategic return.

Mastering budget allocation means taking control of your event’s narrative and, more importantly, its measurable contribution to your company’s growth.

Unlock Strategic Event Value with iCreationsLAB

At iCreationsLAB, we specialize in applying these rigorous, ROI-focused strategic frameworks to every aspect of corporate event management. We partner with you to dissect your business objectives, establish clear CPO metrics, and ensure every dollar allocated drives measurable success. We don’t just manage budgets; we engineer them for profitability.

Transform your event spend into strategic capital. Contact iCreationsLAB today to discuss a truly ROI-focused management plan for your next corporate event.